In Beijing's lively street markets or Guangzhou's quiet alleyways, you'll quickly notice a new way of life: no one uses cash. People's phones light up, and the line moves quickly as they scan QR codes. Over 90% of locals now use mobile payments, so cash and cards are rarely seen. For you as a foreign traveler, this can feel a bit scary at first. But once you understand the system and the tools you can use, paying in China becomes not just simple but also a lot of fun. You won't need to carry a thick wallet or worry about your credit card not working. All the answers are right in your phone. This guide is made just for you to kwon how do foreigners pay in China. We'll walk you through how to pay easily in China so you can focus on enjoying your trip, not on how to handle money.

Using Mobile Payments: Alipay and WeChat Pay

Alipay vs WeChat

Core Functions

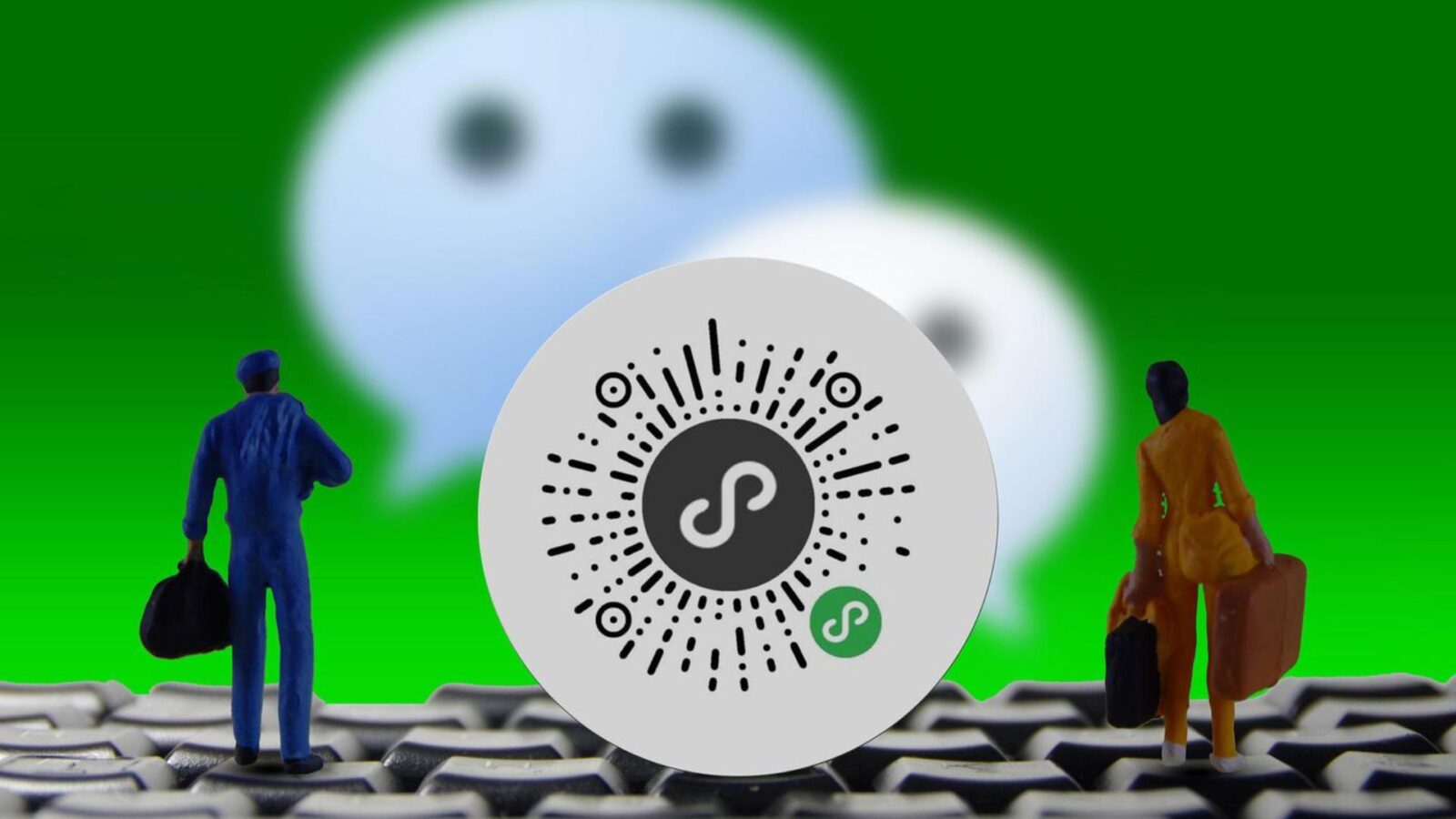

Alipay and WeChat Pay dominate the scene, and they are far more than simple apps. Both rely on QR codes as their backbone: you can either scan the shop’s code or show your own for the cashier to scan. This quick exchange has become the normal rhythm of paying for everything from coffee to metro rides.

Alipay is tied to Alibaba’s shopping empire, while WeChat Pay grows from China’s most popular messaging app. In practice, both work almost everywhere, from Starbucks to night markets. Travelers often find Alipay slightly smoother for online bookings, while WeChat Pay feels more natural if you already use the app to chat with friends. So the question of how do foreigners pay in China starts and ends with these two apps.

Step-by-Step Guide (How to link an international credit card)

Download and Register

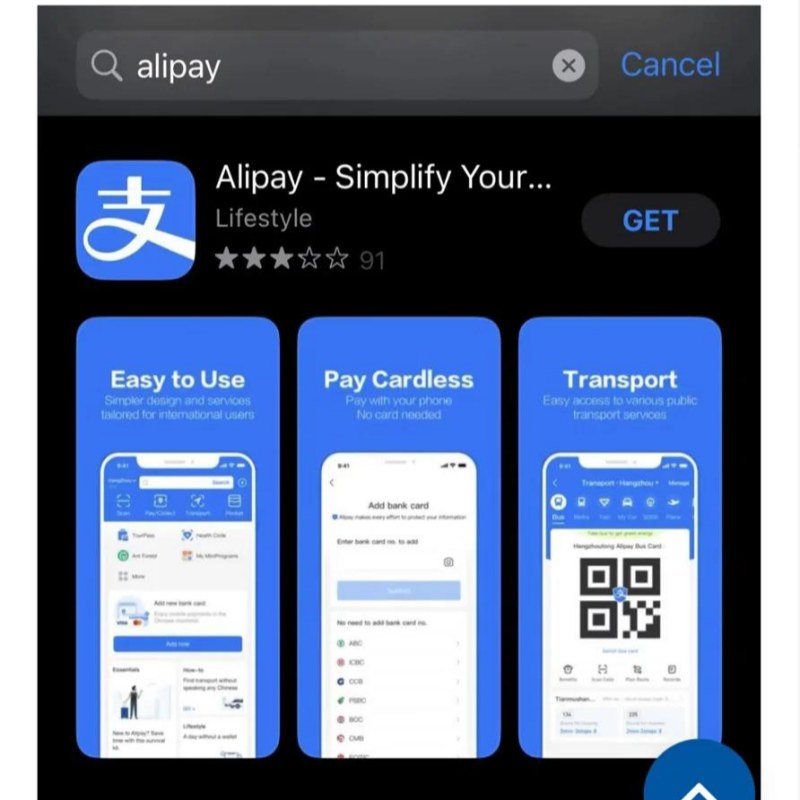

Start by heading to your phone’s app store and downloading either Alipay or WeChat. Choose the international version if available. Use your own mobile number from abroad; the system sends an SMS code that works even without a Chinese SIM. Many travelers do this step before boarding their flight, which avoids fumbling with airport Wi‑Fi later. Once installed, the app will guide you through basic setup screens, including creating a password and choosing your language.

When you first open the app in China, you might face prompts in Mandarin. Don’t panic; both Alipay and WeChat now offer English interfaces once you complete the first login. It can feel clunky, but the apps detect your region and switch. This stage ensures the app is tied to your device and phone number so you can receive confirmations instantly. This initial setup is the fundamental first step in understanding how do foreigners pay in China.

Real-Name Verification

Next comes the ID check. Upload a clear passport photo and type in your details exactly as they appear. Chinese regulations require this verification, and skipping it leaves you with a tiny spending limit, often less than 200 RMB per day. The process might ask for a live selfie to confirm it’s really you, so be ready with decent lighting. This step may feel bureaucratic, but it unlocks the full functionality of the wallet.

Sometimes the verification takes a few hours to approve. You’ll get a notification once it’s done. Until then, don’t worry if payments fail—that’s expected. Once verified, your account can handle normal tourist spending like metro tickets, meals, and shopping without issues. The verification process directly answers the question of how do foreigners pay in China securely.

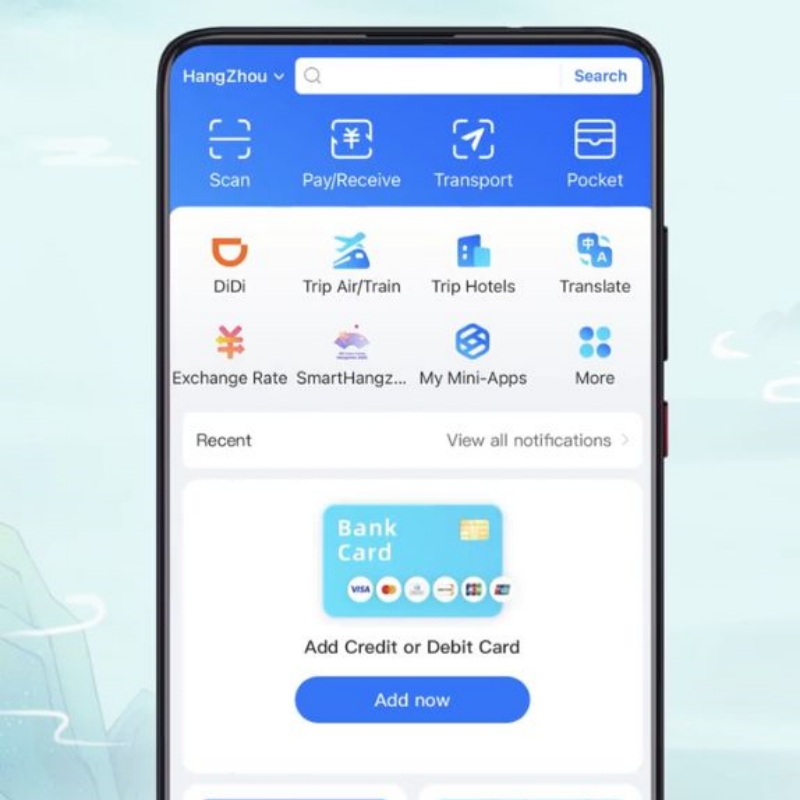

Link Your Bank Card

In the “Cards” or “Wallet” section, tap to add a card. Visa, Mastercard, and JCB generally link without problems, while some Discover and Diners Club cards also qualify. Enter the card number, expiry, CVV, and your billing address carefully. A small test charge may appear, which later disappears, as part of verification. If the card isn’t accepted, try another one—compatibility varies by bank and region.

After linking, set a six‑digit payment password. This works together with fingerprint or face ID, giving you a second layer of security. Once confirmed, you can begin using QR codes in shops, metros, or cafés. Some travelers notice that not every card brand works smoothly on both apps, so it’s smart to have two different cards ready in case one fails.

Wondering how to pay like a local during your China trip? Don’t miss Alipay for Foreigners in China: Step-by-Step Setup Guide 2025

Important Notes

Foreign cards can cover shopping, transport, and food purchases through these apps. What they cannot do is allow you to withdraw cash from ATMs, a limitation that sometimes catches travelers off guard.

Single‑transaction limits usually sit around 5,000 USD, while yearly caps hover near 50,000 USD. On top of that, some merchants or card issuers add extra fees, often around 3%, so it’s worth checking your bank’s terms before relying fully on this method.

Worried about paying without a Chinese bank card? Just check this guide on how to use WeChat Pay in China 2025 — no Chinese bank card needed

Planning a Backup: Carry and Use Cash

RMB

Core Message

Cash isn’t dead, but it's been demoted. Think of it as a safety net rather than your main rope. It gives you peace of mind when apps fail or when you step into areas where mobile coverage is weak. Many travelers admit that pulling out a note in a rush feels reassuring compared to fiddling with frozen screens. In moments like catching a late-night taxi with no signal, that folded bill in your pocket can feel like gold.

It’s also psychological comfort: not everyone wants to depend fully on a phone for survival in a foreign country. Carrying a few notes means you are never left stranded if your battery dies or if the app fails at the wrong time. This crucial backup plan is a key part of the conversation about how do foreigners pay in China.

Specific Use Cases

Street vendors selling skewers, hole-in-the-wall noodle shops, or taxis that still haven’t switched meters—they may refuse QR codes. Rural guesthouses often prefer bills too. Cash is also helpful when buying souvenirs in remote villages or paying for bike rentals where QR payment is not set up. In some cases, locals even give discounts for cash to avoid transaction fees. The human touch still matters here; handing over a note can sometimes build trust with older vendors unfamiliar with mobile apps.

Small entrance fees at local temples, public toilets, or countryside buses are still easier with coins or notes. In these spots, pulling out your phone may simply not work because no scanner exists. These specific scenarios are an important part of understanding how do foreigners pay in China in every situation.

How to Get It

Exchange some currency before arrival, or hit ATMs in airports and big city banks. Stick to small notes—20s and 50s are handy—since vendors may not be able to break a 100 RMB bill. Airport exchanges often have higher fees, so withdrawing from ATMs in town usually gives better rates. Keep notes organized in a separate pouch so you can grab exact change quickly, especially in crowded places. This organization is especially useful in busy markets where speed avoids drawing unwanted attention.

Another option is to withdraw cash at hotel counters or international banks with clear exchange services. Always check fees and avoid unauthorized exchangers on the street. By mixing preparation before your trip with smart withdrawals in China, you’ll always have enough cash for those small but essential purchases where digital tools fall short.

Following the Process: Master the Payment Steps

- download Alipay

- Alipay Home Screen

- Alipay Bill Details

Step 1: Preparation

Before flying in, install Alipay or WeChat Pay and make sure the apps are updated to the latest international version. Register with your number, upload your passport, and link your card while you still have reliable internet at home. Doing this in advance saves you the headache of unstable airport Wi‑Fi or SIM activation delays. Many travelers also print or screenshot their QR codes in case of temporary connection issues.

Once in China, test the apps with a small purchase like a metro ticket or bottled water. This helps confirm your card works and your verification is complete. If there are hiccups, both apps have English customer service chat options, though response times vary. This forward-thinking preparation is vital for travelers wondering how do foreigners pay in China smoothly from day one.

Step 2: Payment Process

At checkout, open your chosen app and choose whether you will scan or be scanned. For Scan to Pay, tap “Scan,” point at the shop’s QR code, and check if you need to type the amount yourself. In smaller markets or food stalls, you often enter the number manually, then confirm with your password or fingerprint. Merchants usually have laminated QR codes on the counter, and the process feels surprisingly quick once you get used to it.

For Show QR Code, open your personal code screen from the wallet section and let the cashier scan it with their device. This flow is common in supermarkets, metro gates, or chain cafés where the system automatically deducts the right amount. The confirmation usually comes with a beep or a flash of green on the cashier’s screen, and your phone shows a digital receipt almost instantly. This seamless process is a core component of the answer to how do foreigners pay in China.

Both methods are safe and efficient, but you should note the subtle differences. Scanning the merchant’s code is flexible when buying from small vendors, while showing your own code speeds things up in bigger, automated systems. Either way, queues move quickly, and the whole routine becomes second nature after a day or two in China.

If scanning to pay sounds tricky, don’t worry — you’ll need both Alipay QR Code in 2025: How Foreigners Can Use It with Zero Fuss and WeChat QR Code: A Quick Guide for Travelers

Step 3: Transaction History and Management

Inside the app, your bill history neatly records every noodle bowl and metro ride. It’s searchable and can be filtered by date or merchant, which is handy for keeping track of travel expenses. You can export receipts or share them by email if you need reimbursement later.

Refunds are straightforward: the merchant scans a refund code or reverses the payment in their system, and the money flows back to your card within one or two days. Notifications confirm the refund instantly, and you can see the status update in your transaction list. It feels cleaner and faster than fiddling with coins or waiting for card reversals abroad.

Exploring Other Options: Discover More Payment Channels

- UnionPay

- JDPAY

- Apple Pay

International Credit Cards

Big hotels and malls may swipe your Visa or Mastercard, but don’t count on it in smaller spots. Always confirm before you order or check in. To use, hand over your card at checkout and expect to enter a PIN instead of a signature. Some stores may add a foreign transaction fee, so it’s best to double‑check with your bank before relying on this method. This is one of the more traditional answers to how do foreigners pay in China.

You often find international cards most reliable in luxury hotels, international airports, and high‑end restaurants. In street markets or small cafés, you’ll rarely see them accepted. For this reason, cards are better seen as backup rather than your main payment tool.

Need tips on cards that make travel smooth in China? Discover Best 8 Credit Cards for China: Travel Smarter, Pay Easier (2025)

UnionPay

China’s own network is accepted everywhere that has a payment terminal. If your bank issues a UnionPay card, you’ll have the smoothest experience, both at shops and ATMs. Using UnionPay is straightforward: insert or tap your card, then enter your PIN. Currency conversion happens automatically if your card is linked to an overseas account.

UnionPay shines in daily use. From metro ticket machines to small convenience stores, acceptance is nearly universal. ATMs across China also display the UnionPay logo, making cash withdrawals hassle‑free.

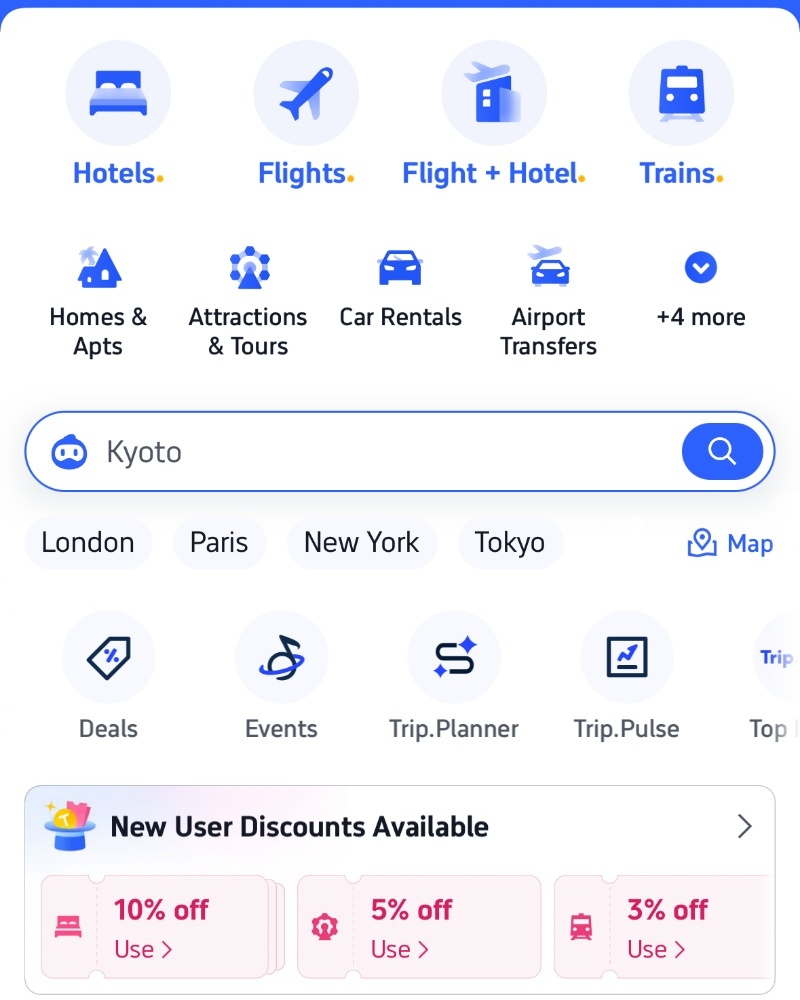

JD Pay

This option is tied to JD.com, one of China’s biggest e‑commerce platforms. It’s most useful when buying goods online or ordering snacks and electronics delivered directly to your hotel. To use it, log into your JD.com account, add a bank card or link to your JD Wallet, then choose JD Pay at checkout.

For foreign travelers who come to China, JD Pay is particularly convenient for purchasing SIM cards, travel gadgets, or snacks without leaving the hotel. Delivery times are fast in big cities, sometimes within a few hours.

Baidu Wallet

Created by Baidu, the country’s leading search engine, this wallet is more niche but still appears in certain online services and app ecosystems. To activate, download the Baidu Wallet app, register with your phone number, and link your bank card.

Baidu Wallet is mainly seen in Baidu‑related services like cloud storage subscriptions or online advertising payments. People may not use it often, but it can be handy if you stumble upon a Baidu‑run platform.

Apple Pay

Apple’s system works wherever contactless payments are supported. Add your card in the Apple Wallet app, verify through your bank, and hold your iPhone or Apple Watch near the reader to pay. The process is instant and secure with Face ID or Touch ID.

Apple Pay is seamless in big chains like Starbucks, McDonald’s, or large supermarkets that support contactless terminals. In smaller, family‑run shops or rural towns, acceptance is inconsistent, so always keep a backup payment method.

Internet Connection

Without internet, your wallet is useless. Consider buying a local SIM card upon arrival, using an eSIM before you leave home, or renting a portable Wi‑Fi device at the airport. Payment apps need a steady data signal to confirm transactions. Test your connection with a small purchase first, such as a metro ticket, so you don’t get stuck at a larger checkout.

Language and Culture

Learn a few Mandarin phrases that directly help in payment situations. For example, ask “shōu bù shōu zhīfùbǎo?” to confirm if Alipay is accepted, or “wēixìn zhīfù kěyǐ ma?” for WeChat Pay. Remember, tipping is not expected; service charges are included in most bills, and giving extra cash may confuse staff. Having small change ready can also smooth interactions in taxis or rural towns.

Payment Security

Always download apps from official stores like Apple App Store or Google Play to avoid fake versions. Enable fingerprint or Face ID authentication to add an extra layer of safety. Be cautious with QR codes: only scan those placed inside shops or displayed on verified terminals. Random stickers on walls or doors can be scams, so double‑check before pointing your camera.

Exchange Rates in China

For quick trip budgeting, apps like XE or Google give a reliable ballpark. But if you actually plan to exchange cash or use your card in China, it’s smarter to check the official rates on Bank of China’s website. Airport and hotel counters usually offer slightly worse rates than the official benchmark, so having the Bank of China figure in mind helps you know if you’re getting a fair deal.

FAQ: Solve Common Payment Issues for Foreigners in China

Q: Can I use my Visa/MasterCard in China?

Yes, but mostly through Alipay or WeChat Pay, as these apps accept international card linking. Direct swipes are possible, but mainly in upscale hotels, international chains, or shopping malls where foreign tourists are expected. Smaller shops and street vendors rarely accept them, so don’t rely on carrying only your card. If you do try to use it directly, expect to be asked for a PIN rather than a signature, and sometimes an extra fee may apply. This is a direct and common question about how do foreigners pay in China.

Q: Do I need a Chinese phone number for Alipay/WeChat Pay?

No, international numbers now work fine as long as they can receive SMS verification codes. This means you can set everything up before your trip if you already have roaming. However, some travelers report smoother verification with Chinese numbers, so keep in mind you might face delays if your foreign carrier blocks SMS from Chinese apps. Having a backup contact method, like email, can also help if verification fails.

Q: What are the transaction limits for foreigners?

Alipay and WeChat Pay allow up to 5,000 USD per single payment, with annual caps around 50,000 USD. These limits usually cover regular tourist expenses like hotels, trains, and dining. Still, keep in mind that some merchants may set their own lower limits for international card payments, so splitting bills or carrying cash is sometimes necessary.

Q: Is it safe to use mobile payments in China?

Yes. Both apps use encryption, real‑time monitoring, and biometric logins such as fingerprint or Face ID. They are generally safer than carrying large amounts of cash. Just avoid connecting to public Wi‑Fi when paying, as it increases risk. If your phone is lost, freeze your account through the app’s website or customer service immediately.

Q: What should I do if the payment app doesn’t work?

Always keep some cash in your pocket as backup. If an app freezes or your card is declined, try a UnionPay ATM for withdrawals or pay directly at a hotel desk, which usually accepts international cards. Restarting the app or refreshing your internet connection also solves most glitches. In rural areas, it’s best to ask about payment options before ordering food or booking services. Troubleshooting is a crucial part of knowing how do foreigners pay in China effectively.

Q: Can foreigners withdraw cash from these apps?

No, foreign cards linked to Alipay or WeChat cannot pull money from ATMs. The apps only process payments. If you need cash, use your physical international card at a UnionPay ATM. Be mindful of fees charged by both the local ATM and your home bank.

Q: Do merchants everywhere accept mobile payments?

In major cities, almost every shop, taxi, or food stall takes mobile payments, making life very convenient. However, in villages or smaller towns, some businesses may still prefer cash. For peace of mind, carry at least 500–1000 RMB in smaller bills for these situations.

Q: Should I exchange money before arriving in China?

Yes, bringing some RMB beforehand is smart. It covers taxis, snacks, or your first meal before you sort out your apps or SIM card. Airport ATMs and bank counters also provide cash, though exchange rates can vary and fees may be higher. For longer trips, it’s better to withdraw from ATMs in city banks for fairer rates.