The impact of Alipay, which originated in China, extends significantly beyond its original geography and today is a familiar sight on streets across the globe. From Tokyo department stores to boutiques in Europe and tourist havens in Southeast Asia, Alipay is being accepted at an increasing number of international merchants. What is Alipay? Tourists often ask the question when they watch visitors on their way to a purchase, scanning a QR code and putting money away in the wallet of their phone.

It’s not simply a payment app; it is among the most potent symbols of the digital payment revolution that is under way around the globe. This article is going to talk a little bit about: Alipay’s history, core functions and its importance in the life of local users and worldwide tourists, which will help you get an inclusive understanding of such a world-changing app!

Understanding Alipay: A Gateway to Digital Life

Alipay

Tracing Its Origins

Alipay was created in 2004, by Ant Group, a financial services company affiliated with Alibaba, to address the trust gap between buyers and sellers on Taobao. It became a safer way to make trades online by holding money in escrow until goods were received. This model soon established itself in the trust of users and became the engine behind a blossoming e-commerce industry in China. It has evolved from being a simple payment solution for online stores to a household name today.

As it extended itself, Alipay became more than a means for digital payments. It invaded people’s everyday life, managing both bills, travel and even lifestyle services. Its transition from a basic escrow system to a central part of the consumer economy demonstrates the dramatic impact technology can have on consumer behavior in a short amount of time.

A Comprehensive Overview of Features

Today, Alipay is a full-fledged digital wallet and super-app. Users can make payments by scanning QR codes in shops, restaurants, taxis and even small market stalls. In addition to payments, the app offers a variety of features including food delivery, ride-hailing, ticket booking, wealth management and public service payments. That broad reach makes it more than just a wallet; this is an all-in-one digital life platform.

Alipay has English support and tourist-friendly features, such as Tour Pass, that allow visitors to pay without a Chinese bank account. This flexibility also illustrates how Alipay has adapted to serve not just locals, but the increasing numbers of international visitors.

The Trajectory of Its Development

Alipay+ is Alipay’s global application that links wallets in Asia and Europe. Partnerships with Visa and Mastercard are helping it to do business at hundreds of thousands of merchants outside the United States. At home, it is still pushing the innovation envelope, with products like Ant Forest and Ant Farm, in which payments are mixed with social and environmental initiatives.

Today, Alipay is one of the main players in China’s cashless economy and also carries clout in the world of digital payments globally. Its evolution — from a trust solution on Alibaba’s Taobao platform to an international app forming new habits around how people and businesses spend, save and borrow — offers a model of how one app can influence consumer behavior and upend traditional banking structures across the globe.

- QR Code Payments

- Ant Forest

QR Code Payments

The core feature is scanning QR codes. It’s the most common way to pay in shops, cafés, and even street markets. Open the app, scan or show your code, and the payment completes in seconds. Beyond cafés and shops, even taxis and vending machines now display QR codes, so tourists quickly realize how wide the adoption is.

This method is deeply embedded in everyday life. Even tiny stalls in small towns display printed QR codes for Alipay. For tourists, this often becomes their first surprising glimpse of how cashless China has become. In larger cities like Shanghai or Beijing, street performers sometimes even display their QR codes for tips, which shows how integrated this system is.

It looks simple, but behind the quick scan is a whole system of encryption and real‑time confirmation. That invisible backbone is why people trust it for both small and large purchases. Each scan generates a new dynamic code, reducing the risk of fraud. The smooth process hides a complex security design that makes both locals and foreigners confident when using it.

Looking for a quick guide to Alipay QR code for foreigners? Discover Alipay QR Code in 2025: How Foreigners Can Use It with Zero Fuss

Everyday Convenience

Alipay integrates services like DiDi taxi rides, Ele.me food delivery, and movie tickets, but also unique local tools like Ant Forest and Ant Farm. These gamified features let users plant virtual trees or raise animals while contributing to real environmental and charity efforts. Visitors often find this cultural element both fun and meaningful.

For visitors, this side of Alipay gives cultural insight. It’s not only about convenience; it connects you with causes that millions of Chinese take part in daily. Using Alipay becomes both practical and meaningful. A traveler might join Ant Forest and later see their contribution reflected in a real tree planted in Inner Mongolia.

Public services also fall inside the app. In Beijing or Shanghai, you can scan a ride code to enter the metro, skipping queues for tickets. It shows how transport and lifestyle weave together inside one platform. Beyond metro systems, Alipay also works for utility bills, hospital registrations, and booking tourist attractions, offering a glimpse into the seamless digital life locals enjoy.

Social and Financial Services

Traveling with friends often means shared meals or activities. Alipay’s bill splitting function lets you divide costs instantly without fuss. After a group dinner, one person pays and others transfer their share in seconds. This feature is especially useful in family trips or tours where shared spending is frequent.

This feature removes the awkwardness of exchanging coins or calculating exact amounts. It has become a normal part of social life in China, from student canteens to business lunches. Visitors often notice that locals rarely argue over who pays, since the app makes the process quick.

For tourists, it’s handy too. Group travelers can manage shared expenses smoothly, making the experience of traveling together more relaxed and efficient. It also helps avoid misunderstandings and ensures everyone feels comfortable, especially when dealing with unfamiliar currencies.

Ensuring Security: Trust and Technology in Tandem

Security of Alipay

Technical Safeguards

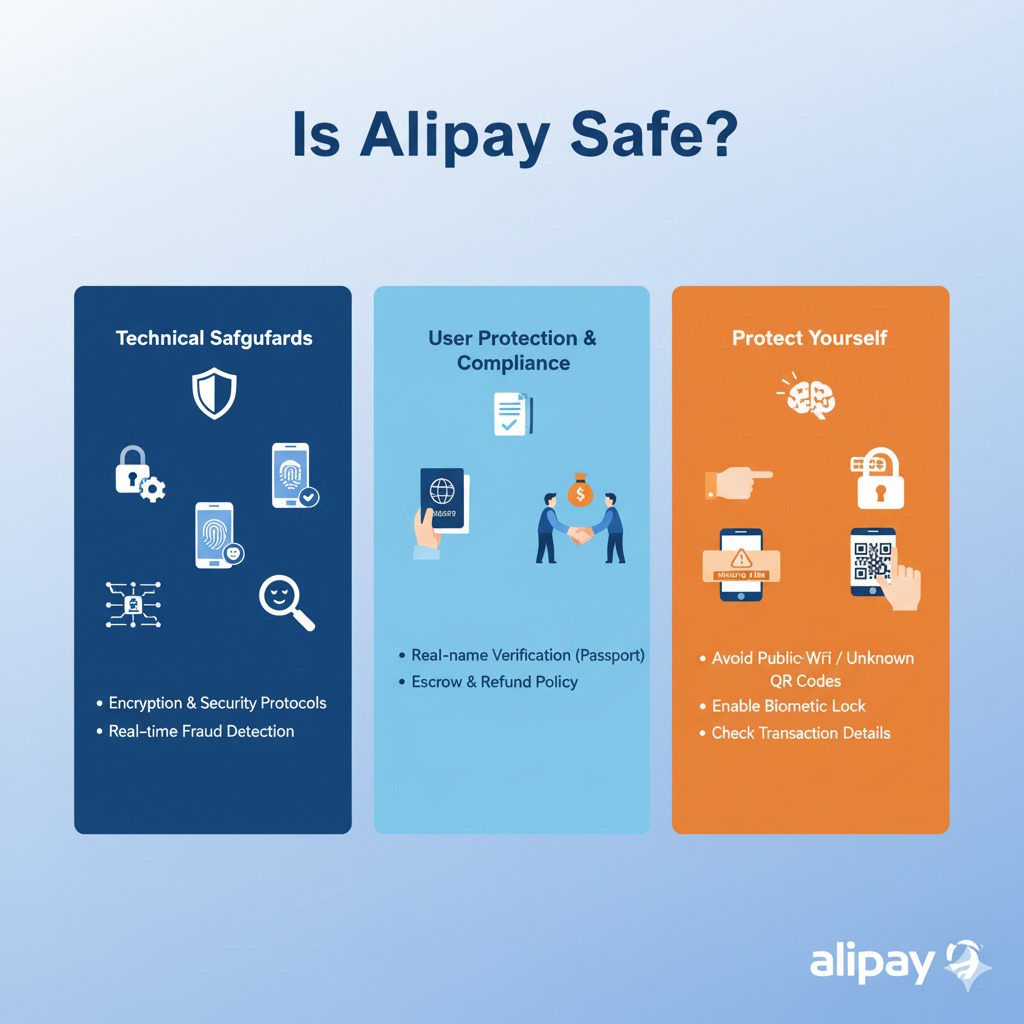

Alipay protects transactions with encryption and strict security protocols. Each payment is locked with advanced codes, so intercepted data cannot be read. This makes users feel confident even in busy public spaces. Biometric checks like fingerprints and face ID add more layers, while SMS codes confirm big changes or transfers. Together, these tools create a strong barrier against fraud.

Behind the app, risk control systems scan every transaction. Machine learning detects odd activity, such as sudden spending in a new city, and can freeze it instantly. This real-time monitoring helps keep fraud rates low. For both locals and visitors, these safeguards explain why Alipay is trusted in daily use.

User Protection and Compliance

Chinese law requires every account to be tied to a real identity. For tourists, a passport submission unlocks full functions and builds traceability. This setup raises the cost of fraud and helps authorities track misuse quickly. Alipay also offers compensation policies for unauthorized losses, giving users a safety net.

Escrow adds another layer of security. Money stays with Alipay until both buyer and seller confirm the deal. If problems appear, users can raise disputes. Customer support assists with claims, ensuring funds are handled fairly until resolved.

Awareness of Scams

Technology works best with smart habits. Tourists should avoid logging in on public Wi-Fi, clicking unknown links, or scanning untrusted QR codes. Phishing attempts are more common than system flaws, so awareness matters. Updating the phone system and app provides the latest fixes, while a lock screen or biometric login protects the device itself.

Checking payment details before confirming and reviewing account history also helps. Quick reactions to strange alerts make a difference. Alipay’s system is strong, but paired with careful user behavior, it becomes one of the safest ways to handle money in China.

Want to know more about whether Alipay is safe? Check Is Alipay Safe? 2025 Guidelines, Risks, and Real-World Advice

Comparing Competitors: The Digital Wallet Landscape

| Comparison | Alipay | PayPal | WeChat Pay | Apple Pay |

|---|---|---|---|---|

| Origin | E‑commerce on Taobao (China) | Silicon Valley, focused on card transfers | Built into WeChat chat app | Apple ecosystem, iOS integration |

| Core Payment Method | QR code scanning, escrow | Credit/debit card linking, online transfers | Peer‑to‑peer in chats, QR code payments | NFC contactless with terminals |

| Market Strength | Daily lifestyle tool in China, wide range of services | Strong in international e‑commerce and small merchants | Popular for social transfers and daily transactions in China | Popular in Western countries with card culture |

| Lifestyle Integration | Services like bills, transport, Ant Forest, investments | Limited mainly to online transactions | Tied closely to chat and social features | Limited to payment only, little integration beyond iOS functions |

| Tourist Experience | Works across shopping, dining, metro, attractions, supports Tour Pass | Accepted globally but less common in offline Chinese merchants | Easy for locals, harder for foreign tourists without Chinese bank account | Limited in China, better in regions with NFC infrastructure |

Expanding Globally: Alipay's International Strategy

Alipay's International Strategy

International Merchants

In Singapore airports or Milan boutiques, Alipay logos stand beside Visa and Mastercard. That’s Alipay+ at work, connecting wallets like GCash or Dana so Chinese users can pay abroad. For tourists, spotting these signs abroad brings comfort—they know their payment method will work.

These partnerships allow even smaller merchants to tap into Chinese spending. Travelers in places like Bangkok night markets or Seoul cafés now use Alipay without exchanging currency. It adds convenience and builds loyalty to stores that display the logo.

For Chinese users living abroad or students studying overseas, this global visibility makes them feel connected back home. Using the same app abroad is both practical and reassuring.

Partnerships and Expansion

Partnerships with major card networks widened acceptance. For merchants, it meant no extra setup, just one integration to reach millions of Chinese shoppers. Big names like Visa and Mastercard helped speed this process up.

These deals also encourage cross‑promotion. For example, a shop in Paris that accepts Visa can seamlessly add Alipay as an option. The shift requires minimal extra training for staff but opens a new customer base.

For tourists, these tie‑ups reduce confusion. When familiar logos stand together—Visa, Mastercard, and Alipay—it reassures travelers they can pay smoothly.

Growing Numbers

By 2024, Ant Group claimed 300,000 overseas merchants accepted Alipay. For exporters or travel retailers, this number signals access to a steady flow of Chinese customers.

The figure isn’t just about scale; it shows confidence from global partners. More merchants are willing to adapt systems to cater to Chinese wallets.

In the long run, this trend suggests Alipay is cementing itself not just as China’s wallet, but as a worldwide option where Chinese travelers go.

For Foreign Visitors: A Guide to Using Alipay

Using Alipay

Account Registration

Foreign visitors might start by downloading the Alipay app from the App Store or Google Play. After you install it, select English as the interface language, which will make it easier to navigate. You need to register by a foreign mobile and can get a verification code while register.

Tourists can start using the basic functions after they have opened accounts whilst their identity needs to be verified for most services. Which is why the risk of the next one is crucial.

Identity Verification

Real‑name verification is mandated by law in China and adds features. Then foreign users must input their passport information, and occasionally, a photo. This takes typically few minutes to complete but it might differ depending upon network.

Finish verification and verify user’s account is invulnerable from any rule violation. Then you could be stuck with only a few services without it.

Linking Bank Cards

Tourists need to link an international debit or credit card to pay in China. Alipay works with major providers including Visa, Mastercard and JCB. It includes entering a card number, confirming via SMS code, and setting a payment password.

Once linked, the card can be used for payment at stores, restaurants and attractions. There may also be some small fees for certain transactions, so it's a good idea to check the terms before making big purchases.

Alipay Tour Pass / Tour Card

If you do not have a Chinese banking card or Alipay account, Alipay also has its special product – Tour Pass for foreign travellers. It lets you preload money on an international card and spend using the app like a local.

Tour Pass balances are good for 90 days, and travelers can refill them as necessary. It’s applicable to transportation, dining, shopping, entertainment, so it’s a useful tool for short stays.

With these steps put together — download, verify, link and preload — foreigners can use Alipay as their primary payment platform, worry free, while traveling in China.

Want to pay like a local without a Chinese bank card? Read Alipay for Foreigners in China: Step-by-Step Setup Guide 2025

Travel Secrets: Enjoying a Worry-Free Trip

Everyday Spending Scenes

Use Alipay at malls in Shanghai, street food stalls in Chengdu, or museum counters—it works almost everywhere. Metro systems in Beijing and Shenzhen support ride codes, so you can scan to enter instead of buying tickets. Even small souvenir shops now accept Alipay. While staff may occasionally be unsure about foreign card links, overall it is widely trusted.

For travelers, this consistency is helpful. Paying the same way at both luxury malls and snack stands shows how universal Alipay has become in China’s cashless push. Keep QR code scanning in mind as your go‑to option.

If confusion arises, remember that most places are familiar with QR payments. Patience and showing your payment screen usually solve the issue.

Things to Watch

Keep your phone charged—no battery means no payment. Carry a power bank or rent one from shared charging stations found across cities. Reliable internet is also key; without it, QR codes won’t refresh. Foreign cards often have daily limits around ¥2,000–¥3,000, so split large purchases.

Alipay itself works without VPN in China, easing one worry. Still, make sure your phone’s iOS or Android system is updated. Older versions may block some functions.

Check menus in English mode for smoother use. It reduces confusion and speeds up payments.

Language and Convenience

Switch to English mode, but expect some alerts in Chinese. To avoid issues, take screenshots of key screens so staff can help if needed. The layout is consistent, so buttons usually stay in the same place even if text changes.

These small steps—setting English language, preparing screenshots, and practicing the payment flow—make a big difference. With a little preparation, even first‑time visitors find transactions smooth.

Overall, treat Alipay as your main tool for daily spending in China. With practice, you’ll find it as natural as locals do.

FAQs: Getting Your Questions Answered About Alipay

Q: How do I create an account on Alipay without a Chinese ID?

A: Overseas users can sign up with foreign passport number and valid active mobile phone number. The app takes foreign phone numbers and sends you a verification code to verify your identity. You might also have to add a card during setup in some cases. Once you have registered, if you change the interface into English you'll find it easier to navigate. Real name verification must also be completed which necessitates passport information. Generally, the registration process is clear-cut and typically only takes a couple of minutes, if documents are prepared.

Q: Can I use Alipay when traveling outside China?

A: Yes. The app, through Alipay+, now functions in many countries, particularly in Asia and some parts of Europe. Duty-free shops, airports, and overseas megamarkets may just bear the Alipay logo. Coverage is expanding, so availability varies by location. Not every mom-and-pop overseas takes it, but more shops sign on each year. What that means for tourists: The same app might work for your China trip and international shopping.

Q: In which currencies can I pay?

A: RMB payments are acceptable inside China, and cross-border spending is available in multiple currencies (USD, EUR, HKD, etc.) on Alipay. Conversion is automatic, but rates may differ. That makes it easier for tourists to pay without having to carry cash in foreign denominations. Other features, though, such as savings or investments are still RMB-only. It's helpeful for international users to know currency conversion fees before dropping large amounts of money.

Q: Is my bank card safe when I pay with my Alipay?

A: Alipay secures linked cards through encryption, biometrics and password protection. Every transaction is checked in real time by fraud-detection systems. Fingerprint or face ID prevents unauthorized access even if you lose your phone. That said, users will need to stay on the lookout for phishing links or fake QR codes, which aren’t common but are not out of the question. Almost all travelers prefer linking with a card to running around with a wad of cash for safety and security (as well as for customer support with disputes).

Q: Can I use International card to pay on Alipay?

A: Yes. Major providers such as Visa, Mastercard, and JCB are accepted. To link, typically you enter card details and then verify via an SMS code. Once you’ve connected, you can use the service to pay at restaurants, shops and tourist sites. Some merchants may also impose small fees, at the discretion of the card provider. Tourists can often access this feature through Tour Pass, which preloads funds from overseas cards to the app. Recommended is to review what your bank’s policies are on foreign transactions before you go.

Q: What works better in China, Alipay or WeChat Pay?

A: Both are widely used, but they are not substitutes for each other so much as focusing on different things. Alipay is famous for extending financial services, lifestyle tools and connections in transport, facilities and more. WeChat Pay is embedded in the chat app, so it’s quite popular for people transferring funds among friends. Tourists usually end up downloading both, but Alipay is typically the more flexible option for shopping, sightseeing and ticket booking. Your choice depends on your needs: for the daily services, Alipay tends to work better.

Q: Why my order payment my by Alipay is failed?

A: Payments could be declined for a number of reasons. A bad internet connection can also make your QR codes from updating. International cards might reach daily or annual limits, especially if Tour Pass balances expire. Another is inadequate real-name verification, which limits some transactions. From time to time, the app will prompt for additional security checks if it sees you doing something on the app that seems out of the ordinary. Tourists are encouraged to have alternatives such as a second card or some cash in order to prevent problems.

Q: Can tourists take metro with Alipay?

A: Yes, quite a few cities offer ride codes. In Beijing, Shanghai and Shenzhen, if you open the transport section and scan directly at metro gates, the value will also be deducted. It's a time-saver over purchasing paper tickets. Then, the system will automatically deduct your fare when you exit. Guests particularly appreciate this during peak hours, when waitlists become long. Not all small towns have integrated systems yet, but in big cities it has been running smoothly and reliably.

Q: So what’s off-limits to foreigners?

A: As of 2024, the spending ceiling is $5,000 per single transaction for verifiable foreign accounts and a $50,000 annual limit. These limits are for a Tour Pass or associated international card. This is more than enough for most tourists, who will spend amount the average amount, factoring in hotels, attractions and shopping. If you’re a business traveler who spends a lot on bigger purchases, your rewards cap is limiting. With the limits, you cannot worry about failed transactions and be able plan on your spending or transactions.

Q: So how does the refund or dispute process work?

A: The Alipay escrow system means that funds remain there pending the confirmation of goods. Should a purchase not work out, you can ask for a refund right in the app. The funds typically return within a few days, but the timeline is up to the merchant. Customer support is available in English for any disputes that may arise. This safety net will not throw anyone for a loop when trying out e-commerce or paying at places you’ve never seen before. It minimizes potential losses to dud trades.